Our service desk has been inundated with calls regarding high internet accounts over the past two weeks.

In one incident unusually high traffic on a user’s account was detected. When investigated it came to light that someone else saw him type his password and used it to download illegal series from the internet.

Information Technology can’t safeguard users in against incidents like these. Unfortunately it remains your sole responsibility to keep your password safe,

Sharing of usernames and passwords are still commonplace on campus, as is writing passwords down on post-its and leaving them on desks.

It’s just as important to keep your network password safe as it is to keep your bank card’s PIN number safe and surely you won’t share your PIN with someone?

With your password someone can not only access your internet, but also your e-mails containing bank and other private information, as well as human resources information – including your salary information! The risk remains the same.

Make sure you use a strong password. Microsoft has some clear guidelines on this.

Always close Inetkey when leaving your PC or lock your PC (ctrl+alt+del). If it’s open, anyone can use it and there’s no way for IT to establish who really used the account if you logged in.

Regularly check your internet usage and make sure you don’t get any nasty surprises. Your internet balance is displayed on the Inetkey prompt box and can also be checked at www.sun.ac.za/useradm.

Keep in mind that the university internet speed and your ADSL line at home aren’t the same speed. You might assume because you’re spending the same amount of time online, it will cost you the same, but downloading is much faster on the university network.

If you notice a sudden increase in your internet usage, lodge a query at IT at the cost of R200-00. More information on internet usage on the SU network can be found in our service catalogue.

Die dienstoonbank is die afgelope twee weke oorval met navrae oor hoë internetrekeninge.

Tydens een insident is buitengewone hoë internetverkeer by `n personeellid se rekening opgemerk. Met nadere ondersoek het dit geblyk dat iemand gesien het hoe hy sy wagwoord intik en dit daarna gebruik het om onwettig reekse daarmee af te laai.

Informasietegnologie kan gebruikers nie beskerm teen gevalle soos hierdie nie. Dit bly uitsluitlik jou verantwoordelikheid om jou wagwoord veilig te hou.

Daar is steeds personeel wat hul gebruikersname en wagwoorde met ander deel of dit sigbaar op `n stukkie papier op hul lessenaar tentoonstel.

Dis net so belangrik om jou netwerk-wagwoord veilig te hou as jou bankkaart se PIN-nommer en jy sal sekerlik nie jou PIN-nommer vir iemand gee nie?

Met jou netwerk-wagwoord kan iemand nie net toegang kry tot jou internet nie, maar ook tot e-posse wat jou bankdetail en persoonlike informasie bevat, sowel as jou menslike hulpbronne inligting – insluitend jou salarisinligting! Die risiko bly dieselfde.

Maak seker dat jy `n goeie, sterk wagwoord het. Microsoft het goeie riglyne daarvoor.

Bo en behalwe goeie wagwoordpraktyk, moet jy onthou om altyd jou Inetkey toe te maak as jy weg is van jou rekenaar of jou rekenaar te sluit. (ctrl+alt+del) As dit oop bly, kan enigiemand dit gebruik en daar is geen manier vir IT om te bepaal wie jou internet gebruik het as jy die een was wat dit ontsluit het met jou wagwoord nie.

Gaan gereeld jou internetgebruik na sodat jy nie aan die einde van die maande `n verrassing kry nie. Jou internetbalans verskyn op die Interkey aantekenblokkie en kan ook nagegaan word by www.sun.ac.za/useradm.

Hou in gedagte dat die spoed van die universiteitnetwerk en jou ADSL-lyn by die huis nie dieselfde is nie. Jy mag dink dat dieselfde hoeveelheid tyd op die US-netwerk jou dieselfde gaan kos as by die huis. Die universiteitnetwerk is baie vinniger en jy gaan meer data vinniger gebruik.

As jy `n ongewone toename in jou internetgebruik opmerk, kan jy `n navraag rig aan IT teen die koste van R200-00. Verdere inligting oor internetgebruik op die US-netwerk kan in ons dienskatalogus gekry word.

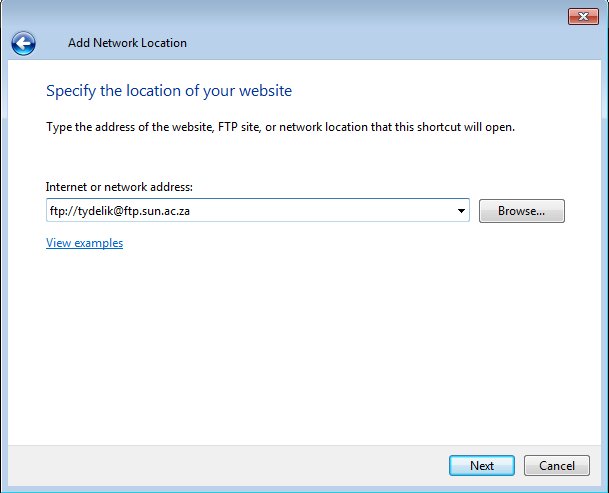

Keep in mind that this space is not for storing or backing up data. It’s merely a temporary spot to put files in order for someone else to easily access them. The person on the other side who needs to access the files will use the same information.

Keep in mind that this space is not for storing or backing up data. It’s merely a temporary spot to put files in order for someone else to easily access them. The person on the other side who needs to access the files will use the same information.